A Loan Application and Origination System (LOS) is a complex software platform used by financial institutions such as banks, credit unions, and online lenders to manage the loan application process from beginning to end.

As a UX specialist, one of the crucial metrics I've identified in the mortgage industry is usability. Some banks or financial institutions use very sophisticated unfriendly legacy applications, while others rely on paperwork, which is a more hectic procedure.

During my 10 years in the fintech industry, and as a part of a design team that collaborated with many mortgage providers and banks. We also attempted improvement in all of the projects on which we worked. We met with several stakeholders and mortgage professionals, read books and articles, and attended mortgage trainings. We have created several iterations and solutions to improve the user experience of the LOS system and Loan application form, which I will go over in further detail in this case study.

In this case study, I'll detail how we approached the solution for the Digital Mortgage Loan Application, which impacted both the business goals and the needs of the customers.

The existing mortgage loan application procedure is inefficient, resulting in delays, mistakes, and disgruntled applicants. Delays can lead to lost business opportunities, increased consumer dissatisfaction and increased operational expenses.

Due to the difficulty or duration of the mortgage application procedure, a significant number of applicants drop out. This results in lost potential sales, lower conversion rates, and lower client engagement.

Incomplete or incorrect data given by applicants causes underwriting issues and delays in loan acceptance. Inaccuracies in application information can generate financial losses, additional burdens for underwriters, and processing delays.

Mortgage application submission and processing suffers by outdated technology and a lack of digital integration. Slower reaction times, reduced customer satisfaction, and a competitive disadvantage in the market result from inefficient digital operations.

Reduce the expenditures of the loan application process, such as paperwork, manual data input, and human resources.

Reduce the time and effort required for customer care representatives to engage with applicants and support them in completing the loan application procedure.

Find ways to increase income by offering extra financial goods or services to applicants.

Assists in approving loans for suitable candidates rapidly, minimising the frequency of denials, and boosting consumer confidence.

Attract a larger pool of applicants, resulting in an increase in the amount of granted loans.

Use modern algorithms and data analytics to correctly analyse applicants' creditworthiness.

Increase the percentage of accepted mortgage loan applications when compared to the total applications received.

Increase the number of applicants who finish the whole application process out of all candidates who began the process.

Reduces the average time it takes to approve a mortgage loan application from the moment it is submitted.

Reduce the number of errors or missing data in the mortgage loan application.

Increase the number of consumers who return to the same lender for future mortgage applications.

Increase the number of mortgage loan applicants who complete the application process and are approved for a loan.

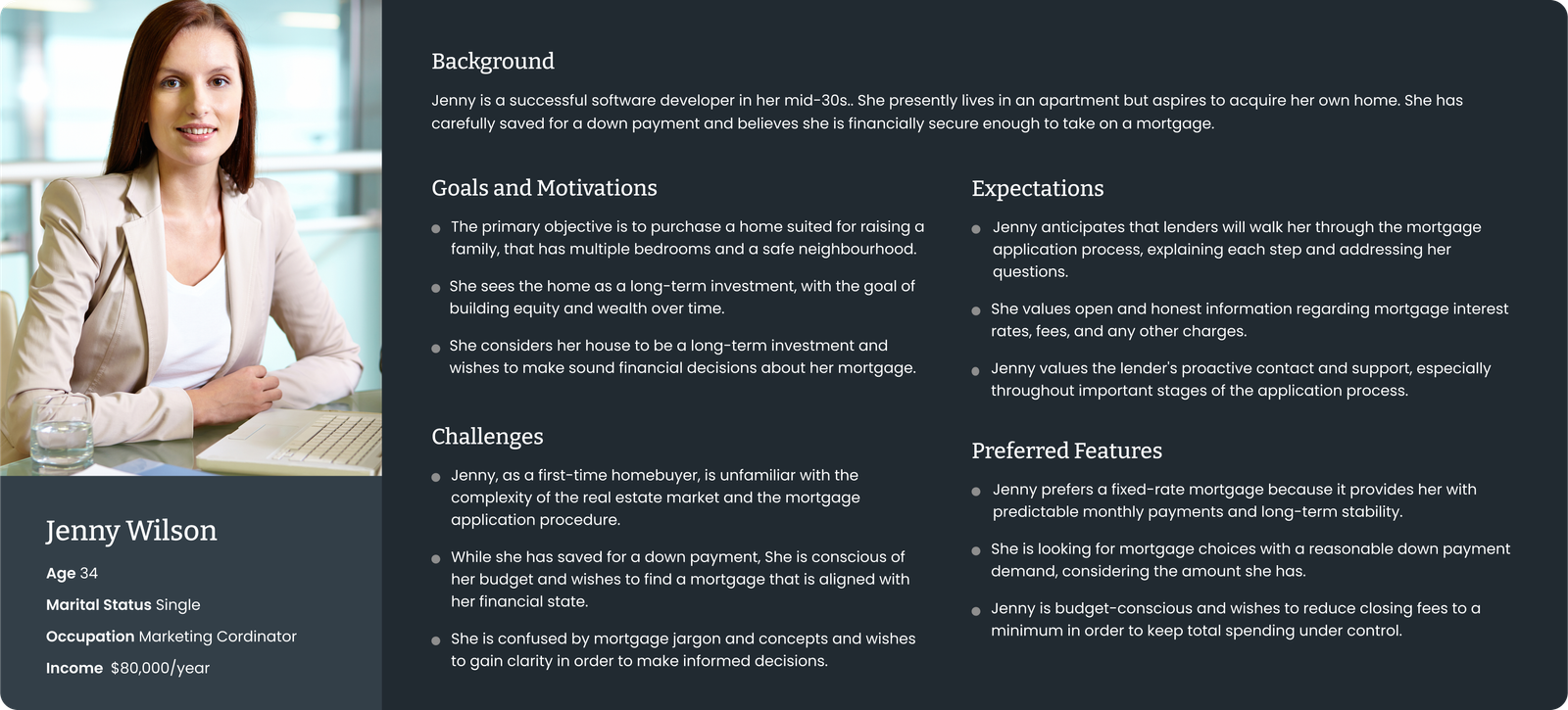

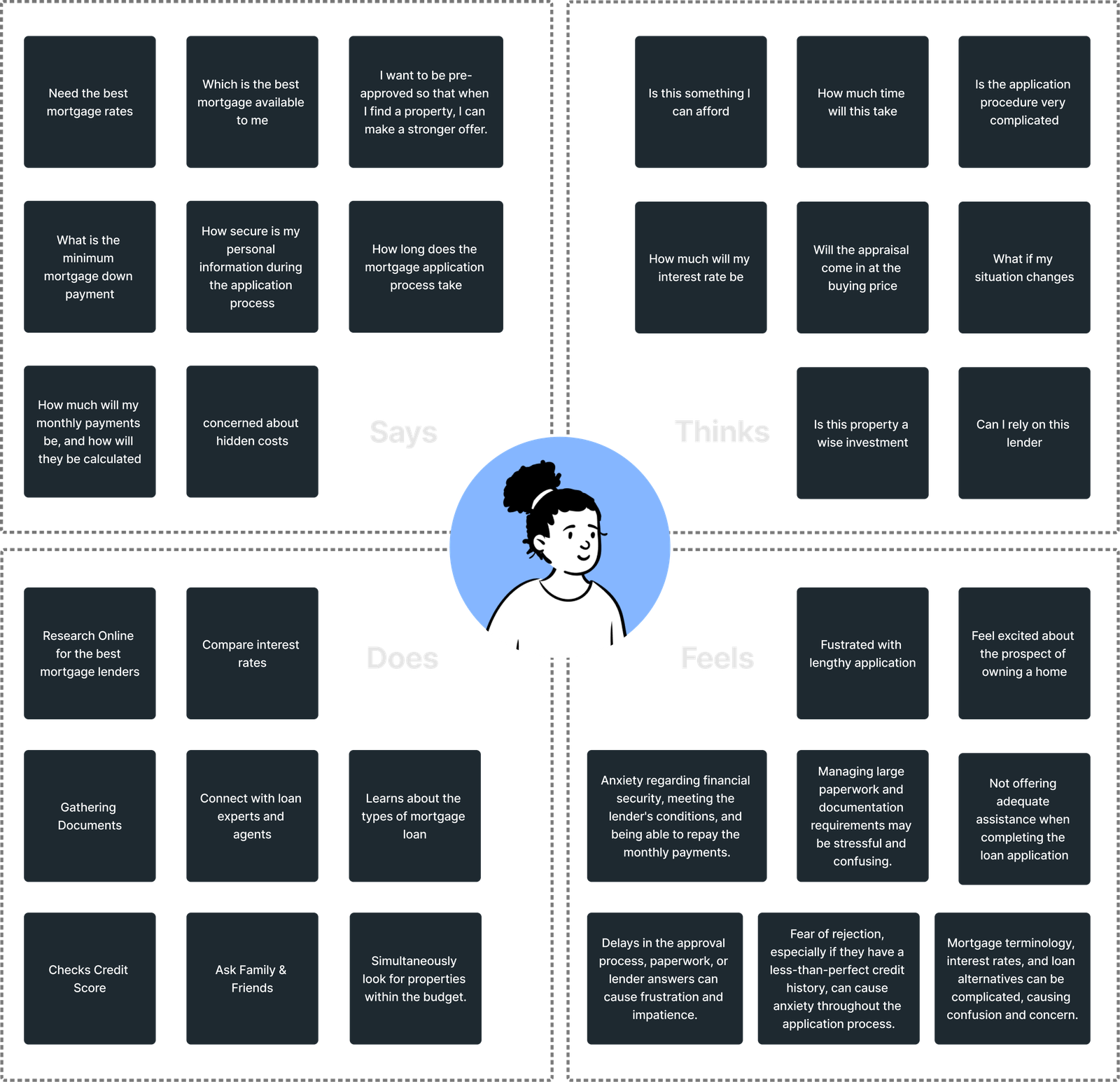

The purpose of this user study is to identify user experiences and pain points during the mortgage loan application process. And discover how to streamline the loan application process.

Individuals or families purchasing their first house.

Needs : Support with the mortgage application process, understanding financing alternatives, and paperwork.

Individuals or families that have previously owned a house and are looking to purchase a new one.

Needs : Streamlined application procedure, and mortgage option comparison, and assisted with coordinating the sale of the present home with the purchase of the new one.

Homeowners who want to refinance their current mortgage in order to get better terms, cheaper interest rates, or access equity.

Needs : Understanding the refinancing alternatives, calculating possible savings, and a simple application procedure.

Most of the time, applicants have to deal with lengthy and complex loan application forms (Digital or Paper)that overwhelm them, resulting in errors and incomplete submission.

Loan approvals sometimes take a long time because of considerable paperwork, verifications, and bureaucratic procedures. Prolonged waiting periods cause financial uncertainty for applicants and might postpone important life decisions such as home purchase.

Most applicants get confused by confusing phrasing or advanced terminology. It is vital to utilize clear and unambiguous language when describing terms and conditions, interest rates, and payback plans.

Because of poorly designed forms that annoy applicants, resulting in the application process being abandoned.

Financial institutions sometimes have complex eligibility standards, making it difficult for many people, particularly those with a poor credit history or a low income, to qualify for loans.

Loan applicants are frequently confused by the numerous stages of the application. Due to a lack of sufficient guidance, the loan application procedure has been halted.

Many applicants are concerned about loan rejection due to poor credit history, financial stability, a lack of collateral, and a low income. To avoid the formal loan application procedure, some people may resort to short-term financial alternatives, such as high-interest payday loans.

A streamlined online loan application allows users to fill out the form quickly and efficiently, and mobile responsiveness allows applicants to view the application from anywhere, at any time.

Asked only the data needed for the first evaluation, such as personal information, income, employment, and the desired loan amount.

To help applicants through the form, used simple language and concise directions, avoiding jargon and complicated terminology.

Ensured that the application form is completely adapted for mobile devices, allowing candidates to apply from smartphones and tablets without experiencing any difficulties with usability.

A non-linear application form tailored to the applicant's situation increases user satisfaction, increases form completion rates, and ensures the loan application process captures relevant and valid data.

A loan prequalification or quick application process involves assessing a borrower's financial position in order to offer an estimate of how much they may be qualified to borrow. The user receives clarity on the qualifying loan amount and prepayment details by submitting minimum information and credit check authorization. This helps to minimize long wait times and a longer loan procedure for eligibility, and it also allows the loan officer to instantly interact with the applicant for assistance.

Implemented algorithms that automatically pre-approve candidates based on the information given. Applicants should be informed clearly of their pre-approval status.

It provides applicants with real-time information on the progress of their applications, allowing them to understand where they are in the approval process.

It enables applicants to monitor the status of their application and connect with the lender at any time, increasing convenience and flexibility.

It contains message or chat options that allow for direct connection with loan officers or customer care professionals, as well as rapid response to inquiries.

Simplified the document upload process for a loan application to improve the user experience and streamline the application process.

Document requirements and formats must be clearly established. Examples and recommendations were provided to assist candidates in preparing and uploading required papers.

Developed on-demand document upload procedure, applicants only upload documents when they are required and according to the current stage of the application.

Document validation services are integrated to automate document validation and eliminate the need for manual checks.

Simplified the document upload process for a loan application to improve the user experience and streamline the application process.

A Frequently Asked Questions (FAQ) section is included, which tackles typical questions about the loan application procedure, qualifying criteria, paperwork requirements, and more.

In-app guidance was implemented using tooltips or pop-up messages that clarify specific fields, assisting applicants in understanding what information is necessary.

The application status tracker allows applicants to watch the status of their loan application, guaranteeing transparency and reducing anxiety.

Providing applicants with specialized loan officers or customer relationship managers as a single point of contact provides individualized assistance and builds a better client relationship.

Video assistance, articles and blogs, and other online tools are available to applicants to help them better understand complex stages, document submissions, and mortgage terms and laws.

Borrowers can use rate quotes to understand the loan terms they are applying for. By offering clear, tailored, and honest rate quotations, businesses not only assist applicants in making educated decisions but also build trust, which is essential in the financing process.

Mortgage calculators are powerful tools designed to assist consumers in estimating possible mortgage payments, determining affordability, and making educated decisions regarding home finance. verified the accuracy, user-friendliness, and interoperability with diverse devices. It can improve consumer interaction and allow for more informed borrowing decisions.